Earned Income Tax Credit (EITC) & Families

“Creating Community-Designed Approaches for EITC Uptake in Rural North Carolina,” is a project that will focus on understanding ways to help more eligible families take advantage of the Earned Income Tax Credit (EITC), a federal benefit that historically has shown success in lifting families out of poverty. The federal EITC was created in 1975 to assist low- to moderate-income working families, particularly those with children, by eliminating their income tax liability. For households with three or more qualifying children, the EITC can mean a credit of up to $6,557.

Money Left On the Table

More than 20% of the NC’s qualifying households never claim the EITC. As a result, families and poor communities are collectively losing $450 million annually – money that would boost household incomes and improve health.

In North Carolina, many rural communities are struggling with the loss of jobs and a lack of economic opportunity. In these communities, particularly those where people of color reside, workers are trying to make ends meet on poverty-level wages, about $26,000 for a family of four. The struggles these families and their children experience because of poverty can result in poor and disparate outcomes across their life course – from infant mortality, to third grade reading, to chronic disease, and beyond. Families of color who reside in these communities are especially impacted because they face additional barriers to financial advancement.

About the Project

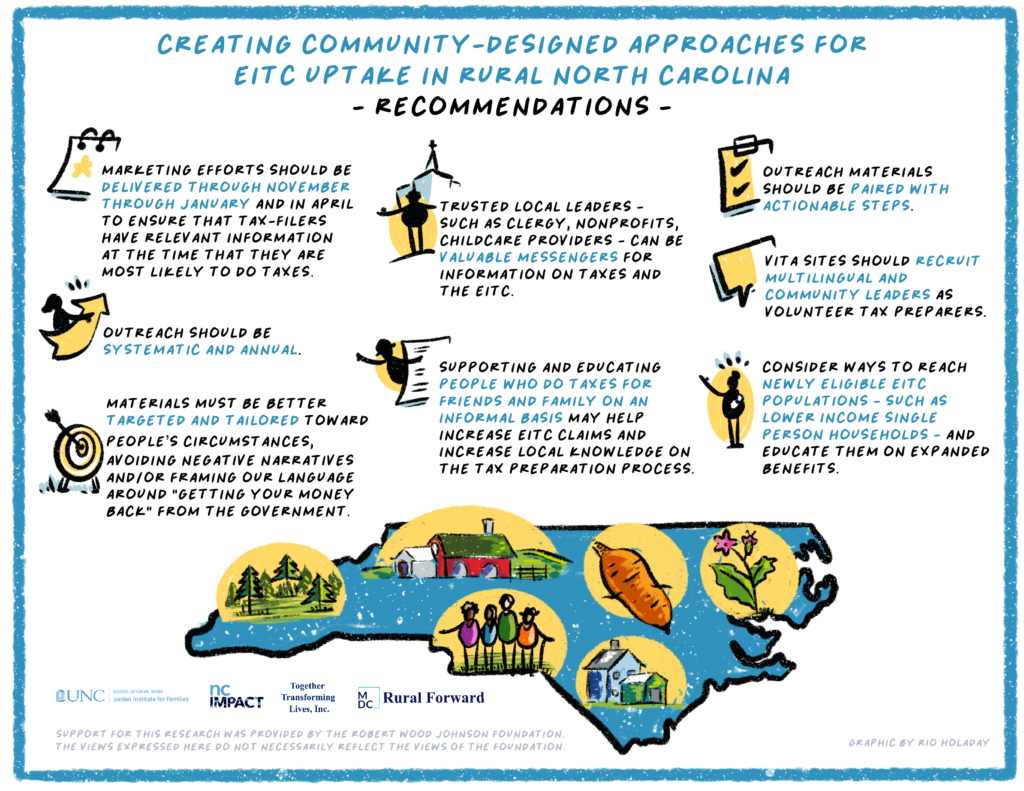

Funded by the Robert Wood Johnson Foundation, the team will examine the role of the federal EITC in improving the lives of some of the nearly 4 million people in the state’s small towns and rural communities. The study will focus specifically on McDowell, Rockingham, Robeson, Beaufort, Nash, Halifax and Edgecombe counties.The goal of this project is learn more about out how we can increase access to financial resources through EITC for rural communities, particularly those where people of color reside.

The project’s interdisciplinary team includes co-principal investigators Sarah Verbiest with the Jordan Institute for Families and Anita Brown-Graham with UNC School of Government and ncIMPACT; co-investigators Calvin Allen with Rural Forward NC; Danny Ellis with Together Transforming Lives, Inc., Paul Lanier, with the UNC School of Social Work, and Whitney Afonso with the UNC School of Government. The project team includes Katherine Bryant, Phillip Sheldon, Joey Rauch, and Jessica Dorrance.

Importantly, the project is led by a Statewide Steering Committee made up of community leaders from across the focus counties. They play a vital role in leading the research and in creating community solutions. This helps to ensure that the interests, needs and voices of the community uplifted and driving this important work.

Members of the Statewide Steering Committee include: Heather Adams (Rockingham County SmartStart), Shelton Daniels (Eastern Carolina Ministerial Alliance), Ralph Gildehaus (MDC), Beth Messersmith (MomsRising), Eric Murray (Cape Fear Regional Bureau for Community Action), Juvencio Rocha Peralta (Association of Mexicans in NC), Amy Stevens (McDowell Access to Care and Health), Dr. Monica Taylor (World Tabernacle Church), Anthony Tyre (Eastern Community Care Foundation), and Mysha Wynn (Project Momentum).

Click here for a flyer with EITC basics. Click here for an EITC info graphic. Click here for things to know about EITC and Tax Preparation.

Research Questions & Design

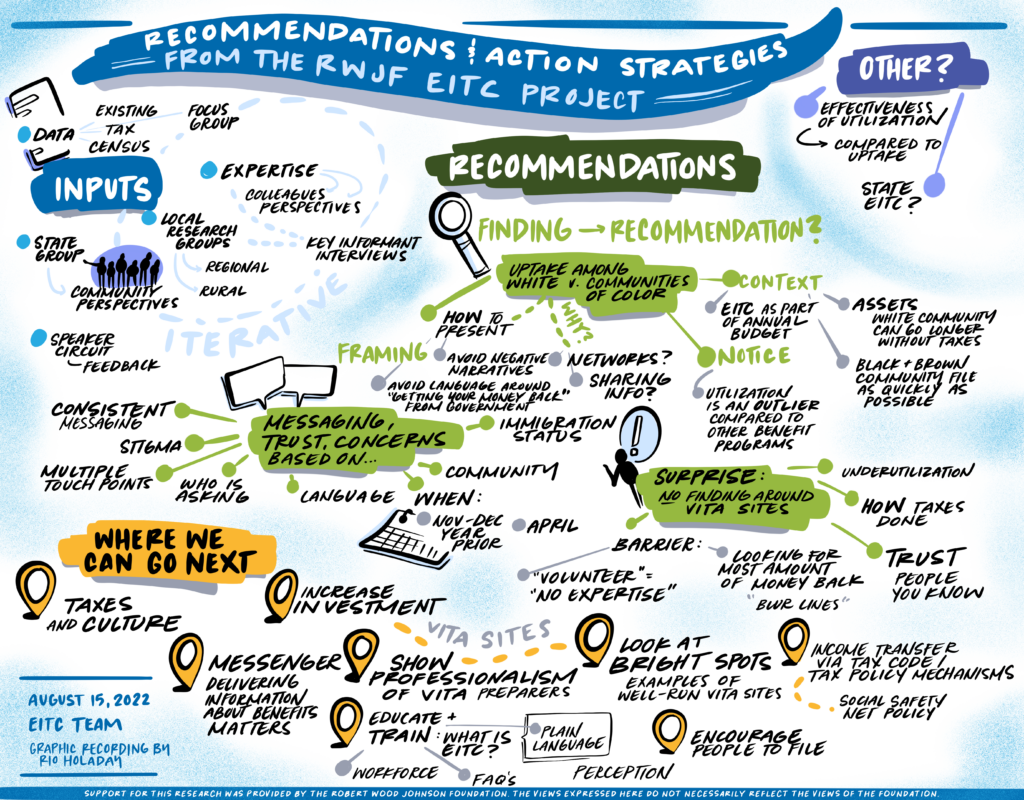

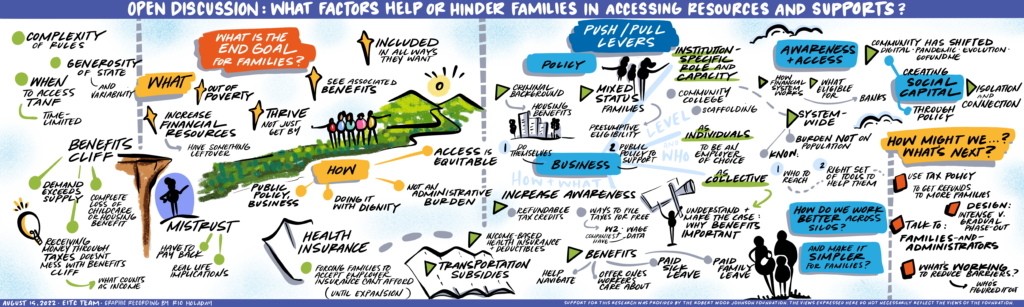

We are focused on learning more about EITC uptake in rural North Carolina, exploring individual, community, and systemic influences on access and use. We will work alongside community leaders and stakeholders to identify strategies for increasing EITC uptake in target, rural counties. We are proposing a concurrent mixed-methods study using participatory research methods and literature review as well as quantitative data analysis. Local research teams comprised of community leaders from the focus counties will guide the work.

Aim 1: Develop a comprehensive understanding of federal EITC uptake in NC.

Initial Research Questions: Which population subgroups are least likely to take advantage of EITC in rural areas of NC? How do rural and urban areas differ on uptake of EITC? How does use of EITC by NC residents compare to residents in states with and without a state-level EITC? How have patterns of EITC uptake changed before, during, and after the state EITC? What are the personal, community, and institutional factors that community residents report supporting and inhibiting EITC uptake? How do those factors operate within communities with significant numbers of black and brown residents?

Aim 2: Identify strategies that rural communities can utilize to increase uptake of federal EITC, and potentially other supports.

Initial Research Questions: What resources are available in communities to support uptake? How might strategies from other states and urban areas be adapted for rural communities? What barriers / facilitators exist for creating new partnerships and leveraging existing resources / relationships?

Findings

We have wrapped up our research and are excited to share what we have learned! Read our paper where members of our team used county level information to study associations with EITC participation rates in NC from 2010 to 2017. Also, visit this site to learn more about EITC and get tips on how to increase your uptake. Don’t forget to watch this video where we discuss EITC and explain our findings.

Below find videos and images that outline our work!

Resources

Click here to review information gathered about Tax Preparation, Rurality, and the EITC in North Carolina. Click here to read a shorter form of the info in a blog.

Click here to read our April 2021 blog – Things to know about EITC and the American Rescue Plan.

Here are some resources about the EITC that might be helpful.

What is the EITC

https://www.taxoutreach.org/tax-credits/earned-income-tax-credit/

EITC Eligibility

https://www.taxoutreach.org/tax-credits/earned-income-tax-credit/eligibility/

Income Limits and Range of Return

Finding a Volunteer Income Tax Assistance Site

https://irs.treasury.gov/freetaxprep/ OR https://nc211.org/2021/10/01/tax-preparation-assistance/

Tax Law Assistance

Stay Connected

Updates about the project will be shared via social media, the JIF newsletter, on the events page and through blogs. Questions? Click to contact Sarah Verbiest or call her at 919-843-2455.

About the Robert Wood Johnson Foundation

Support for this research was provided by the Robert Wood Johnson Foundation. The views expressed here do not necessarily reflect the views of the Foundation.

For more than 45 years the Robert Wood Johnson Foundation has worked to improve health and health care. We are working alongside others to build a national Culture of Health that provides everyone in America a fair and just opportunity for health and well-being. For more information, visit www.rwjf.org. Follow the Foundation on Twitter at www.rwjf.org/twitter or on Facebook at www.rwjf.org/facebook.