Public Benefits Cliffs: 2 Steps Forward, 1 Step Back for Working Families in North Carolina

When most people get a raise or a chance to earn more money, it can help their family get caught up on bills, reduce debt, save for emergencies or retirement, get a car fixed – the list goes on.

Unfortunately, for lower-wage workers earning a raise or taking on extra hours for extra pay puts them at risk for losing public benefits like Medicaid or childcare assistance – pushing them towards or off what experts call the “benefits cliff”, the subject of a report I recently wrote for the U.S. Chamber of Commerce Foundation.

To qualify for many public benefit programs, a family’s income cannot be higher than eligibility limits. The monthly income limit for a family of four persons living in Pitt County to qualify for a Housing Choice Voucher (which helps people pay for rent) is $2,954. If a family had monthly income of $2,800, a $1 an hour raise (an extra $167 a month) for a working parent would put them over the limit and disqualify them for assistance. As a result, the family would pay an additional $463 a month for rent – the difference between the assistance and fair market rent for a 2 bedroom apartment. This family would lose money by taking the raise.

Or consider childcare. In North Carolina, the monthly income limit for childcare assistance for a family of 4 is $4,625 and families pay a 10% co-payment. For a family with 2 working parents and 2 children ages 2 and 4 living in Catawba County, if monthly income rose from $4,200 to $4,800 because a parent got a hiring paying job, their monthly childcare costs would soar – from $420 to $1,585. This family would lose money by taking a higher paying job.

Working parents – especially single parents – are very tuned in to and concerned about losing these subsidies if their earnings rise. Childcare subsidies encourage women to enter the workforce and help mothers continue to work while reducing gender pay gaps.

Childcare subsidies are the only type of public benefit that directly affects whether parents can get to work. If a parent loses their subsidy, they may have to use a different childcare arrangement that is located further away from work, offers fewer hours of care, and/or offers lower quality care.

Yet benefits cliffs are only an issue for the 14% of eligible families that receive childcare subsidies. The larger problem is a lack of affordable childcare in North Carolina – a fact acknowledged by the N.C. Department of Commerce and the lack of adequate reimbursement childcare providers receive which results in an underpaid and financially unstable early care and education workforce.

What about health care? For starters, it is wonderful news that North Carolina at long last decided to expand its Medicaid program. This action will eliminate the Medicaid-ACA coverage gap but workers will face a different type of benefit cliff when they get a job that offers health insurance. These workers will go from paying no or low monthly premiums to an average family premium of $515 per month. Unfortunately, if their employer offers a plan that meets ACA requirements, workers cannot opt for a less expensive ACA marketplace plan with premium tax credits – they are forced to accept higher-cost health coverage or be uninsured.

Benefits cliffs also prevent workers from advancing in their careers, which robs employers of hiring qualified workers in health care, education, and other high labor need industries while depriving the state of higher tax revenue. For example, a Certified Nursing Assistant (CNA) who wishes to go to school to become a Licensed Practical Nurse (LPN) will experience short- and medium-term decreases in net financial resources due to benefits cliffs, which may act as a disincentive for career advancement.

Do all public benefits programs have the disastrous cliffs I describe above? Fortunately, no. The Earned Income Tax Credit (EITC) encourages parents to enter the workforce and has a gradual “phaseout” rate as the person’s income increases. For example, the benefit decreases by only 16% for a single parent with one child whose earnings rise to the income limit.

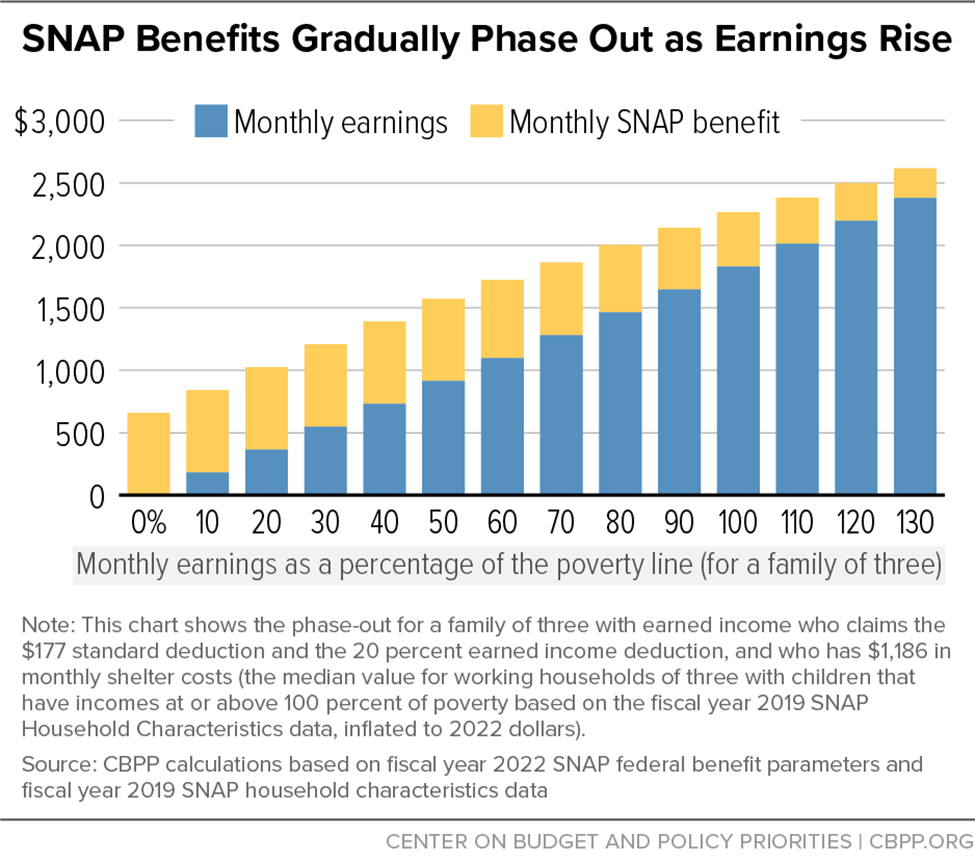

The Supplemental Nutrition Assistance Program (SNAP) is another example of benefits that gradually phaseout as earnings and other forms of income rise as reflected in the chart below from the Center for Budget and Policy Priorities:

What’s the answer? How do we really make work pay and stop penalizing lower-wage workers and their families when they slowly start to get ahead? We need both private and public sector solutions. For example, employers can:

- Help employees with the cost of childcare – especially if they lose their public subsidies.

- Offer wage-tiered health insurance premiums.

- Make a Health Savings Account (HSA) contribution equal to the deductible amount for lower-paid workers – especially employers that offer high-deductible health plans (HDHPs).

- Offer tuition reimbursement to help workers advance in their careers.

In the public sector, all public benefits programs should gradually phaseout as income rises (like the EITC and SNAP) and programs should eliminate asset limits, as North Carolina has done for SNAP under federal Broad-Based Categorical Eligibility (BBCE) provisions. Concerning health care, the ACA should be amended to allow workers to decline health coverage through their employer and opt-in to a comparable and less expensive ACA marketplace plan with premium tax credits.

Policy makers should increase overall childcare funding to eliminate existing waiting lists, reach more eligible families and strengthen the early care and education system. In addition, policy makers can:

- Raise the initial (“entry”) income eligibility limit to 250% of the federal poverty level (same as neighboring states Tennessee and Virginia but still less than South Carolina)

- Raise the continued (“exit”) income eligibility limit to the state median income.

- Incrementally increase the co-payment requirement between the entry and exit income limits so families phaseout of subsidies more gradually.

- Eliminate the co-payment requirement for families with income up to 150% of the federal poverty level.

- Allow families to continue to receive subsidies for 6 months after the recertification at which their income exceeds the exit limit.

Financing these improvements will be a major challenge. The most important thing employers can do is advocate for the changes outlined above, such as galvanizing support in the business community to improve childcare affordability and improving the quality of early care and education.

Want to learn more about Benefits Cliffs? Check out the Federal Reserve Bank of Atlanta’s Career Ladder Identifier and Financial Forecaster and Leap Fund – a nonprofit organization focused on benefits cliffs.